8 Important Questions To Ask Yourself to Become a Master of Your Money

Asking these 8 important questions will shed light on whether we are masters of our money or we have a lot to learn (or fix) in our personal finance. These questions focus our attention on our current financial state and help us figure out a plan to help become masters of our money.

These questions focus our thinking about money and personal finance. By continually asking ourselves these questions, it is my hope that we can accomplish our financial goals. I hope you become masters of your own money by asking these questions to yourself.

-

How many dollars do I earn every month?

It is time to get specific. The question is not ‘how much’ but how many dollars exactly?

Do you know how many dollars you make every month (down to the cents)?

We can answer this question by looking at our take-home pay (after taxes and benefit deductions). This could be the amount that is directly deposited to your bank.

For most of us, if we get paid a bi-weekly paycheck, we will have to do the calculations to figure out how much we earn each and every month.

It is time to do some calculations yourself. Use this guide:

- This is how much I make every paycheck: ______________ (Ex. $xxxx.xx)

- I receive this number of paycheck every month: ________ (Ex. 2)

Assuming that you make about the same amount every paycheck, we can multiply the amount by the number of times you receive a paycheck per month.

Now, time to do the calculations and fill-in the information.

I make this many dollars every month: $____________

-

How much money do I spend every month?

This question will be the toughest one to face for most of us. Mainly, it requires us facing our current reality and doing a lot of tracking down and calculating.

We have to do work to find answers to these questions. Since we are on this journey together, let’s do the work, shall we?

How much do I spend on my expenses every month?

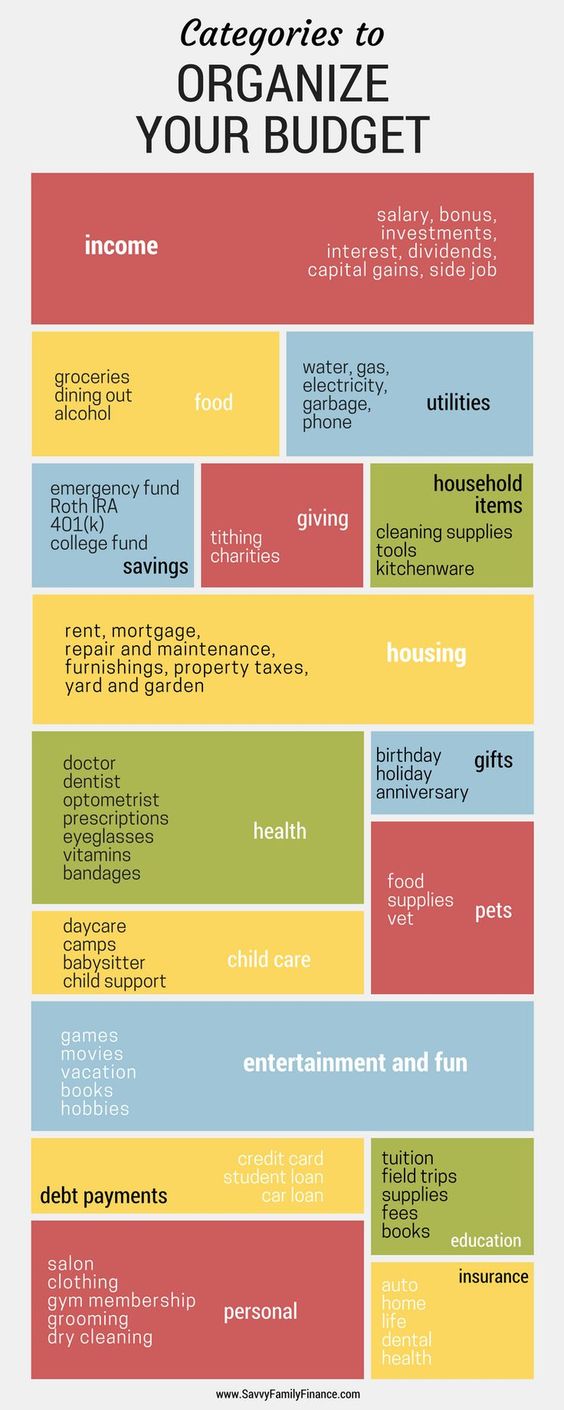

Let’s break expenses down into 3 categories: fixed expenses, variable expenses, and periodic expenses.

Fixed Expenses: These are monthly expenses with fixed amount. Examples are:

Example:

Fixed expenses (monthly):

- Rent / Mortgage

- Cell Phone Bill

- TV / Internet Bill

- Gym Membership

- Any online monthly membership bill (e.g., Netflix)

- Monthly Parking

- Subway/Bus Monthly Pass

..and so on.

List these items using Google Sheet or Microsoft Excel to create two columns, one for the category and the other for the dollar amount that you can fill-in later. It should look similar to this:

| Fixed Expenses (Monthly): | Amount ($x.xx) |

| Rent | $xxxx.xx |

| Monthly Train Pass | $x.x |

| TV/Internet Bill | $x.x |

| Cell Phone Bill | $x.x |

| Netflix Subscription | $x.x |

| Monthly Parking | $x.x |

Now time for the next expense type: variable expenses.

Variable Expenses: these are monthly expenses that have varying amounts every month. For example, our food bill, electric bill, or car gas bill.

A thing to note is that a fixed expense for me, may be a variable expense to you. For example, your phone bill can be a variable expense if the amount is not the same every month. On my end, since I have an unlimited plan for my phone bill, it is a fixed amount every month and therefore it is a fixed expense for me.

So now, time to list our variable expenses:

Example:

Variable expenses (monthly):

- Food and Grocery

- House Gas Bill

- Car Gas Bill

- Restaurant Bills

- Movie Bills

- Coffee Bills

- Clothing Bills

.. and so on.

The last expense is the periodic expense.

These are the types of expenses that somehow creeps out of nowhere. This could be your yearly car registration fee, or your annual membership to Amazon prime. Time to list these here.

Note: periodic expenses is something you should watch out for — in many ways make sure these expenses are not a surprise. It is good to look into these expenses, try to cancel or lower these expenses every year.

Periodic expenses:

- Car Registration Fee

- Amazon Prime Fee

- Credit Card Fee

- Annual Membership Fee

- Website Domain Fee

..and so on.

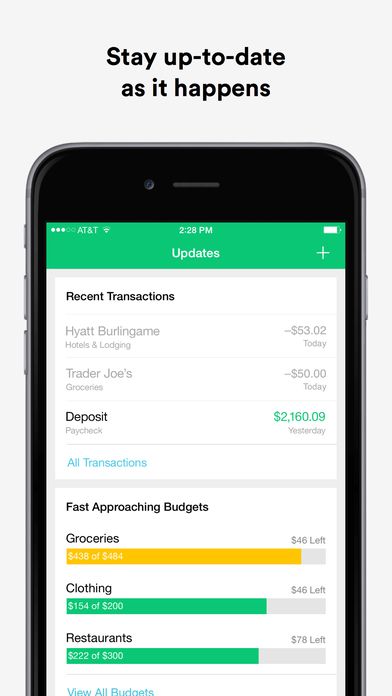

There are easy ways to do these calculations automatically. By using sites like Mint.com you can connect all your accounts and the site will calculate all of these expenses and create a budget for you. Check it out!

-

How much Emergency Fund do I need (and is my EF replenished)?

An Emergency Fund (EF) is a ‘rainy day’ fund that we keep tucked and never touch. These funds are for ‘emergency use’ only. Think of it like cash stored behind a glass case that you must break with a hammer in order to use. The point is that this fund cannot be touched, however it should be liquid and available.

If you have zero EF, start stacking now. Start with at least a $1,000. If you have to scrape money together by selling stuff to get to this $1,000 goal, do it ASAP.

The proper amount of an Emergency Fund is 6-8 months of your monthly expense. This includes fixed and variable expenses, such as rent, food money, etc. If we have done the calculation on #2, we should know that amount here: monthly expense = $ _______.

The EF = Monthly Expense x 6-8 = $___________

(For example, if you averaged $2,850 of monthly expense, the proper EF = $17,100 (6 months).

You must continually stack and save up to this amount to replenish your EF.

Where to save your EF? I would recommend an online bank that requires a bank transfer. This ensures that you cannot readily get to the money (to avoid using it for anything other than emergencies).

Note again, that it is so important to have an Emergency Fund, as this is the money you need for emergencies such as a loss of a job, health-related expense, and any other emergencies that life throws at you. The EF is our umbrella during rainy days so we must make sure to have one. It also helps us feel better and get a good sleep at night knowing we have this fund just in case.

-

How much do I pay myself?

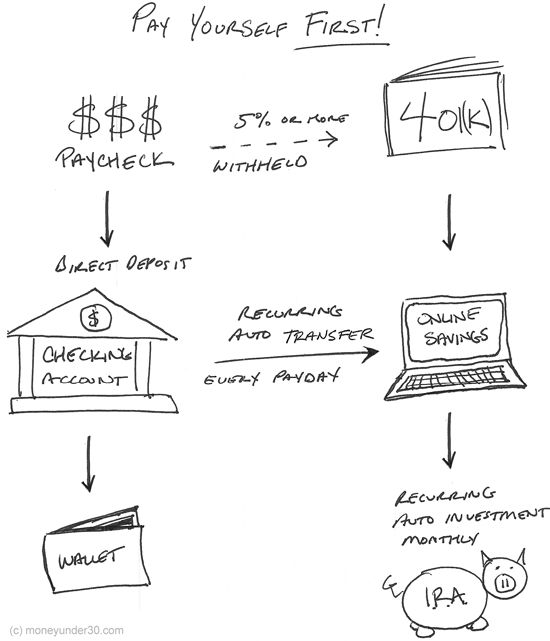

The mantra is always the same: “Pay yourself first!”. This is something I have written about before, but this is also what I call a “Self-Tax”.

If you have wondered why the government takes taxes away from your salary before you can even get to it, the government knows this much. They are paying themselves first with your salary by default.

Paying yourself first is one of the ways you can save the money that you earn and give it to you.

Before you can even spend that money, you must set aside a portion to yourself, call it the “Self-Tax”.

I have written about this before, but the standard “Self-Tax” you should impose to yourself is no less than 10%. The more you increase this amount, the more you get to keep and save.

For example, if your paycheck is $1,000. The 10% means, $100 goes to pay the “Self-Tax”. Now where should this money be allocated? I recommend that this money should go to one of the following options:

- Save or replenish your EF until your goal is met, then move on to 2.

- Retirement accounts. If you have a 401K from work, I suggest using that to ensure you “pay yourself first” before the government. Put up to the maximum amount that your employer matches. Sock the rest on a Roth IRA, up to the $5,500 annual limit. Then go to step 3.

- Savings account, until your goal is met. (This could be future goals such as saving for a down payment on your next car, or that new computer that you need, or replacing your couch, etc. These are expenses that you should save up for before you make the purchase).

The idea with paying yourself first is — to save and allocate that money to the YOU fund. It is important to pay yourself before you get down to paying for expenses. To make this seamless, make this deduction automatic if you could.

-

How much money should I put away for retirement (or invest) yearly?

Do you know how much you need for retirement? If we go with a standard 4% withdrawal rate of the money, and say you need about $80,000/year to retire. Here are the calculations.

You need to divide the yearly income from the rate of withdrawal.

80,000/.04 = $2,000,000. You will need at least $2 million dollars in retirement, that would be your goal.

This means, aggressively saving during your early years — and leaving your money to grow via compound interest.

This is a good calculation to know your end goal and to gauge how much money we should be putting into our retirement fund.

The best way is to utilize your company’s 401K and sock as much as you can (or at the minimum up to the point of the company match). Then save the rest using a Roth IRA or any form of IRA you prefer.

Use the proper form of allocation, for the long haul select an index fund with the lowest fees (e.g. S&P Index 500). Make it consistent and go for the long haul. Whether the market goes up or down, leave your money growing and keep stacking.

-

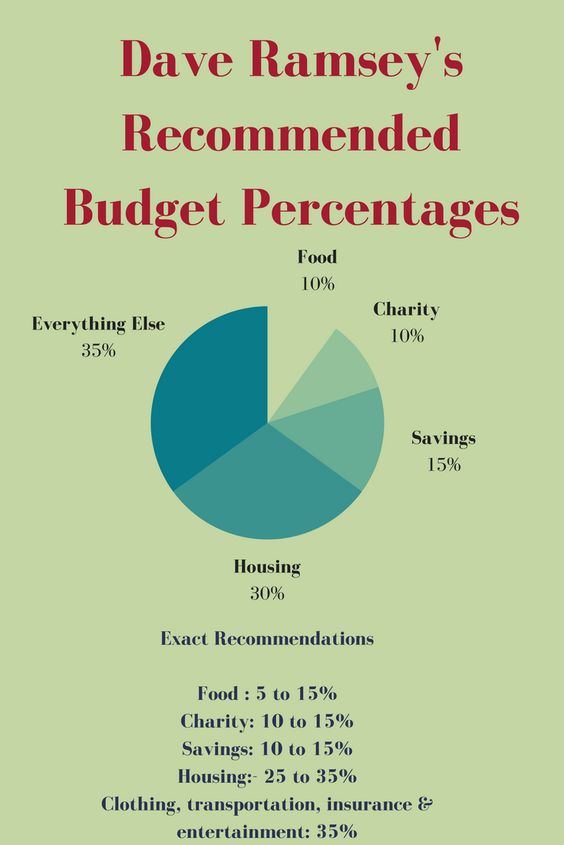

How much money can I cut-down on expenses and how much can I donate this year?

The best way to increase the amount of money you have now is by cutting expenses. This includes all expenses!

Could you find an apartment that is $100 cheaper per year? If so, that could be $1,200 more money you can save.

Could you find a way to move closer to your work and not take the bus or subway everyday? If so, that’s the bus/subway fare money and time you can save.

Find ways to always be vigilantly cutting your expenses.

That Starbucks coffee every day adds up — make your coffee at home and bring it with you.

Going out to restaurants every week is expensive, cook at home instead or say “no” to going out to save money.

Becoming frugal is the best way to ensure that you have more money to save. Especially if you need to replenish or hit your EF goal or save for something.

Deferring today’s wants so you can have a better future is the best way to go.

Donating money is also a way to create an abundance mindset.

If you do not donate money to charity, start doing that now. This helps those in need and also affirms to yourself that you have an abundance.

If you are too tight with giving away your money, the universe will also become tight in giving you the abundance that is already yours.

By giving money and by respecting your money through frugality, you ensure that you have a healthy relationship with money.

-

What is my current net worth?

The difference between the poor and the wealthy is that they can easily answer the question about net worth. How much do you really have?

This is in essence the calculation of all your assets minus your liabilities and expenses. Using a site like Mint.com makes this very easy to figure out if all of your accounts are online.

Now that we have our net worth, it would be good to figure out what someone with our age ‘should-have’ as a net worth. There is a useful formula:

Target Net Worth = (Age – 27) x Annual Pre-tax Income/5.

This formula factors in our age and our current income. Though income fluctuates as we age, this formula is only meant to give a ballpark figure or range.

For example, if you are earning $50,000 yearly at age 33, your Target Net Worth is calculated as:

Target Net Worth = (33 – 27) x ($50,000)/5

Target Net Worth = $300,000/5 = $60,000.

You should have at least $60,000 minimum.

You can find this formula discussed in this The Simple Dollar site here.

-

How is my relationship with money now?

Do you feel content about money? Happy? Frustrated? Scared? Fearful?

Our feelings with money often dictates whether we invite financial abundance into our lives or we push it away. The more negativity we feel about money — results in an unhealthy relationship with money.

This question is a very personal one and one we must ask ourselves. If we feel fearful and frustrated about money, it may mean we need to examine the true reasons why we feel this way. We must address these feelings so that we can work towards a solution for overcoming them.

In whatever way possible, money should be viewed simply as a tool. Becoming mindful that it is neither positive or negative. But having lots of money is actually a good thing to have. We live in an abundant universe. Life grows and flourishes. Your money should too. It is similar to planting a seed, watering it, and watching it grow — to provide for you.

If we think money is the root of evil and other such notions, we will push money away. If we see it as negative — we stop the abundant flow of it into our life.

This is a good question to ask and to probe yourself for every year. Our relationship with money is like any relationship, it is either healthy and flourishing or it is not.

I hope you enjoy this post and I hope you find it helpful. I would love to hear from you!

Please feel free to leave a comment or drop me a message.