8 Reasons For Bank Runs (And How to Protect Your Money)

We had a dramatic weekend, as regulators saw bank customers rushing to access their money in Silicon Valley Bank (SVB) before it completely failed. As of this writing, SVB has failed, while the next bank to suffer the same fate this weekend was Signature Bank in New York. The next bank that regulators are closely watching is San Francisco-based First Republic Bank, which currently is in its last leg as JPMorgan Chase & Co. has stepped in to inject funds to help it keep afloat.

What is going on, and why are banks failing? In this article, we will explain the causes of these bank failures and bank runs and then conclude with ways to protect ourselves, our families, and our money.

1. Federal Reserve Raising Interest Rates

The Federal Reserve has been raising interest rates to fight off inflation, and these actions could cause bank runs. Although these chains of events can be complex, when the Federal Reserve raised interest rates, it was more expensive for banks to borrow money from the central bank. Therefore, borrowing and lending rates increased as well, this led to a decrease in demand for loans because it’s more expensive to borrow money.

People are now avoiding borrowing money for anything from car loans to real estate loans because it is more expensive to pay off. Furthermore, fewer people getting loans mean less economic activity, which causes declines in bank assets.

Regarding SVB, fewer deposits came in as capital funding dried up. Second, the market value of its securities which are mostly 10-year Treasury paying 1%, declined when everyone could just go to the government and get the 3.5% rate.

Tight money lending and less economic activity constrain banks, especially if a bank is not prepared for this downward movement.

2. Fractional Reserve Banking

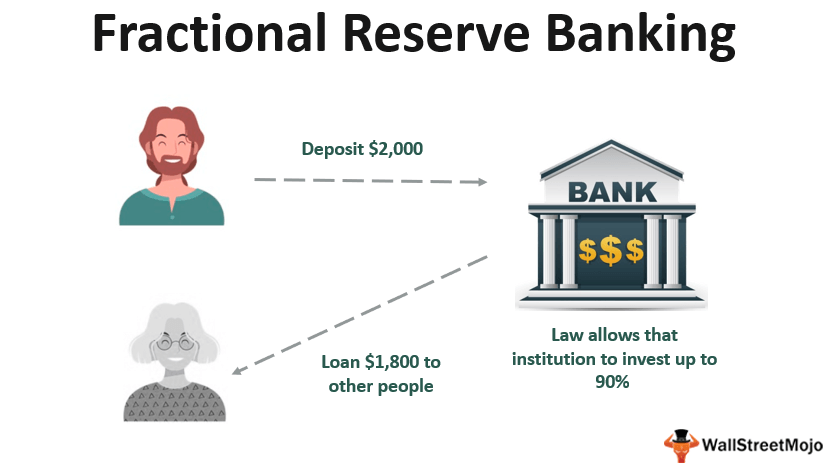

A “bank run” could be a problem because our financial system practices what we call fractional reserve banking. This way of banking means that the bank only keeps a small fraction of the bank deposit available for withdrawal. Where does the rest go? The bank loans your money to other people and institutions, making them even more money. Sounds like a scam, right?

Because we allow banks to keep a small portion of customer deposits on hand while lending out the rest, there is not enough money if everyone decides to take their money out of the bank.

Fractional-reserve banking was supposed to let money circulate in the economy, which some argue helps stimulate the economy. However, many critics of this system argue that it can create a danger to customers, such as what we see now, bank runs.

3. Loosening of the Dodd-Frank Act Provisions in 2018

The Dodd-Frank Act is a comprehensive finance reform law enacted in 2010 in response to the devastation caused by the crisis of 2008. The law addressed the root causes that led to the 2008 crash, such as lax regulation of financial institutions and risky financial products. Basically, it was a way to curve the greed and corruption of banks.

Well, in 2018, the prior administration led by President Trump overturned key provisions of this law. It reduced oversight, decreased capital requirements, and pretty much turned a blind eye (again) to the bank’s corruption. Politics aside (both parties are the same), the new easing of regulations meant that banks did not have to be so strict when using our money to do risky things such as investing it.

As we all know, investing badly can cause money losses, and so these banks were also exempt from disclosures and other requirements that would have secured depositors. These changes loosened more risky behaviors from banks and could cause an increase in systemic risk in the financial system.

4. Unrealized Losses From Risky Behaviours

These banks had unrealized losses.

Silicon Valley Bank and Signature Bank have $620 billion worth of unrealized losses after they sold low-interest Treasury bonds a while back that was now affected by the increasing rates from the Federal Reserve. Basically, these values crumbled, and they are now sitting at a $620 billion loss that they are trying to sell off at a much, much lower value than they put in.

When the Federal Reserve sent interest rates surging at a historic pace, these banks saw their investments go down in flames.

In addition, many of these banks also invested in mortgage-backed securities. These investment products are pooled mortgages and loans sold off to groups of investors. Further, these are ironically the same schemes that caused the 2008 crash, which again became a problem as loans crashed when the interest rates shut up.

As of last week, SVB sold billions of dollars of securities at losses to liquidate enough cash for customer withdrawals. Correspondingly, this event further triggered worry, leading to bank runs and its ultimate collapse last Friday.

5. Peter Thiel Triggered Bank Run

If depositors all suddenly withdraw their deposits, a bank run can happen since they don’t have enough cash at hand to meet everyone’s requests. Peter Thiel has been accused of triggering the SVB bank run when he accused the bank of mismanagement and not having enough assets to meet its obligations.

In cases like this, a bank can have a liquidity problem, most of their assets need to be sold off in order for them to obtain cash for all the depositors needing their money now. The media has recently accused of Peter Thiel’s influence when he called out SVB, and because this bank was primarily used by venture capitalists and start-ups in Silicon Valley, where Thiel is a major player, his voice was heard loud and clear.

“To be clear, SVB did not properly hedge its risks against two threats, 1) concentration of influence by Peter Thiel, 2) rising interest rates,” tweeted investigative journalist Dave Troy. “That was mismanagement, but it stil wasn’t fraud, and they still have sufficient assets to meet nearly all of the bank’s obligations.”

Source: https://www.washingtonexaminer.com/news/business/svb-collapse-peter-thiel-silicon-valley-

6. Corrupt and Short-sighted Leadership

Greg Becker is the Silicon Valley Bank CEO, and two weeks before this collapse he sold $3.6 million in company stock to cash out before the failure. Furthermore, Becker also lobbied to loosen banking restrictions such as the Dodd-Frank Act and others.

SVB management’s greed and corruption were the criteria that caused the bank to collapse. SVB’s depositors were mostly startups. Therefore, they deposited cash that they received from investors into the bank. In addition, SVB lent a large portion of its money to the government and homeowners through mortgage-backed securities.

There are definite unethical practices in banking, not just in SVB but within major banking establishments. The short-sightedness of the banks caused the bank to run as most of their assets were not readily available for depositors, causing their collapse.

7. FDIC Protection

The FDIC has guaranteed $250,000 of depositors’ money in cases of collapse. However, the rest were not guaranteed because most of these depositors had more money. Although, as of this moment, President Biden and the Federal Reserve has stepped in to seize the bank’s funds and injected fluidity so that depositors did not lose their money.

Is this a bailout by the government again, similar to the 2008 crash? Possibly.

Consequently, Silicon Valley Bank and Signature Bank depositors have been told that their deposits have been guaranteed. The Federal Reserve, Department of Treasury, and Federal Deposit Insurance Corporation (FDIC) have stepped in to help.

However, with the rising interest rates, we may expect more collapses of banks in the United States (and possibly the world). And the question we should all ask is, does the FDIC have enough in its arsenal to protect all banks?

8. What To Do To Protect Ourselves

There are steps we can consider to protect ourselves and our money in case of a bank run. I have already written about alternative investments such as gold and silver here and here, but here are steps we can take now.

- Keep Deposits in FDIC-insured banks and stay within limits – This may include ensuring you keep your money in a major bank and do not exceed the $250,000 per depositor limit, which is the insurance amount per bank. Avoid any small banks at the moment because the system protects larger banks in cases of bank failures.

- Monitor Bank Health By Staying Informed – Follow the news and keep informed about your bank’s financial health by regularly checking the news and the bank’s financial statements. This may be hard, but a distressed bank with declining profits could be in trouble. Also, pay close attention when bank ratings get downgraded, as this could mean trouble ahead.

- Diversify – Do not put all your money in one basket but instead spread the deposits across other banks or credit unions, so you reduce your exposure. In addition, this is more important if you have more than $250,000 of cash at hand, don’t put in more than that amount.

- Keep Cash At Hand – It’s important to have cash available when you need it so that you do not have to go to a bank in case of emergencies. Keeping money in your safety box can be helpful during bank runs.

- Don’t Panic, Stay Calm – When disaster strikes, it is important to stay calm to think clearly. Take proactive steps to protect yourself and do not panic, as panic could lead to rash decisions.