8 Ways to Becoming Smart Like Charlie Munger (Learning the Inversion Mental Model)

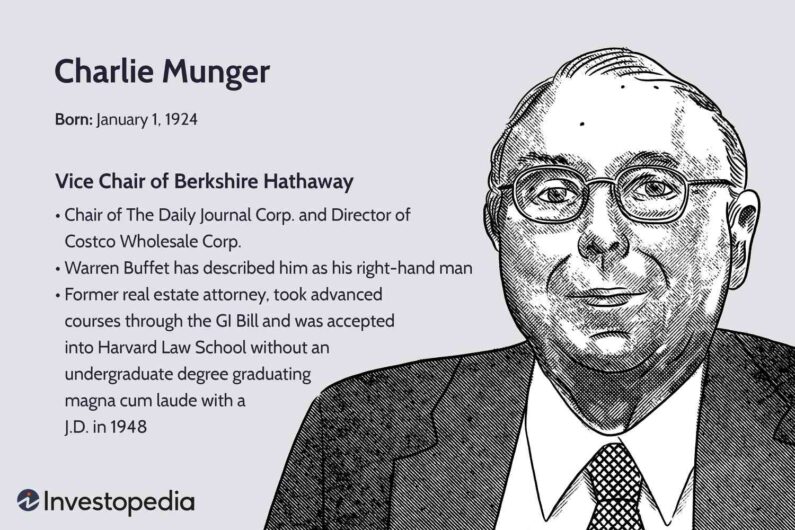

Charlie Munger is considered one of the greatest investors of the 20th century. As a Vice Co-chairman of Berkshire Hathaway with his brilliant and well-known partner Warren Buffet, they created an investment portfolio that produced staggering wealth. Charlie’s secret is his reliance on a formalized way of thinking called “mental models” that has served him throughout his life to become successful.

What makes Charlie’s mind tick? What does he refer to as his “bag of tricks” that he relies on to analyze and dissect the businesses and investments that have made Berkshire Hathaway and his portfolio of investments such a success?

“I was very lucky because every place I’d looked, at the pinnacle, there was a guy that was better than I was …

But I would never be as good as he was, and everywhere I looked, there was somebody like that, and there was all this folly out there, and I suddenly realized like I just avoid all the folly you know maybe I can get an advantage without having to be really good at anything.

And I kept doing that all my life, and it worked so well that I enjoyed sharing it with people like you. It really works to tackle much of life by inversion, where you just twist the thing around backward and answer it that way.”

— Charlie Munger, YouTube

1. What is a mental model?

Warren Buffet often remarked that Charlie Munger is one of the fastest thinkers he knows. Buffet said that Munger could scrutinize a company and quickly assess whether it will be a good investment in record time. How does he do it? Well, one of the ways that Munger has honed his mind through decades of work is by using mental models.

What exactly is a mental model? Mental models are frameworks for understanding very complex ideas and information. Furthermore, mental models can become a map in a sea of information, we use mental models to understand information and broaden our perspectives. Additionally, mental models can become a specific lens to help us understand and view information.

You may already know some well-known mental models. Here are some examples:

- The law of Supply and Demand in Economics refers to the relationship between the quantity of a good or service producers offer for sale (supply) and the quantity consumers are willing to buy at a given price (demand).

- The Pareto 80/20 Principle. The idea states that 80% of effects come from 20% of causes.

- Occam’s Razor. This is also known as the Law of Parsimony, which suggests that the simplest explanation is usually the closest to the truth and, therefore, the best explanation.

- Darwin’s Law of Natural Selection states that organisms with advantageous traits can survive over time and reproduce. Therefore, those traits are passed on to their offspring.

2. Introducing the Inversion Mental Model

One of the most well-known advocates of inversion was Carl Gustav Jacob Jacobi (1804-1851), a German mathematician and great philosopher who famously said, ” Man muss immer umkehren” (“one must always turn back”), which means “Invert, always invert.”

Jacobi found that inverting or addressing a problem backward was the most effective approach to solving a complex mathematical problem.

“Munger’s approach of solving problems backward was influenced by Carl Gustav Jacobi, a nineteenth-century algebraist who famously said, “Invert, always invert.” But Munger tells me that he also honed this mental habit of inversion with help from his friend Garrett Hardin, an ecologist who shared his fascination with the dire repercussions of shoddy thinking: “Hardin’s basic idea was, if somebody asks you how to help India, just say, ‘What could I do to really ruin India?’ And you think through all of the things you could do to ruin India, and then you reverse it and say, ‘Now, I won’t do those.’ It’s counterintuitive but it really helps you to reverse these issues. It’s a more complete way of thinking a problem through.”

“ One core idea Munger has borrowed from algebra is that many problems are best addressed backward. For example, by avoiding stupidity, a person can often discover what he or she wants through subtraction.”

Tren Griffin

From: Charlie Munger: The Complete Investor (Columbia Business School Publishing)

When we start with the problem, there are multiple pathways to the goal or solution. Charlie Munger suggests using inversion to determine the solution by working backward. Preferably, we can avoid the pathways that lead to failure and are more likely to travel a path that leads to the solution or the goal.

In 2020, Charlie Munger described how he used inversion when he was young. During World War II, Munger worked as a meteorologist for the U.S. Air Force. He applied the inversion mental model to identify potential risks and avoid the dangers that could cause him to fail at his job by asking a simple question: “Suppose I want to kill a lot of pilots. What would be the easy way to do it?”

Munger used inversion to work backward; what were the likely causes of failure? He thought there were two things:

- Getting the planes into cold temperatures that would cause them to ice up could cause a crash.

- Getting the pilot into an area where the plane could run out of fuel before they could safely land.

Therefore, by determining these two items, Munger avoided these scenarios, which resulted in him becoming a better meteorologist and saving lives by inverting the problem and ensuring it never happened again.

3. Start at the End, and Work Backwards

We can use the inversion mental model method by defining the problem or goal we want to achieve, then inverting it and thinking about approaching it from the end to the beginning. We can think about the opposite outcomes that would prevent us from reaching the end and then avoid them.

Beginning at the end will help determine the pathways that lead to success and eliminate the choices that will not lead to the goal.

“Instead of thinking about how you can achieve something, think what would prevent you from achieving it.”

4. Focus on Long-Term Value (Instead of Short-Term Quick Fix)

Charlie Munger has consistently advocated focusing on long-term value investing. This method of investing focuses on solid fundamentals and a sustainable competitive advantage for the company to survive and thrive for a very long time. Furthermore, Berkshire Hathaway often sticks with the same stocks a value investing method aimed for the long haul, ignoring the market’s upsides and downsides.

Focusing on the long term also works in other ways. For example, when we think for the long haul, we shape our thinking to invert the goal. We make better decisions that ultimately lead us to the success or the goal we want.

When we think about the long-term consequences of our actions and make decisions for our future selves, we can avoid making stupid mistakes now. Additionally, we can chose wisely by projecting our decisions into the future and asking ourselves whether we will hit or goal or not if we choose this decision. For example, if our goal is to stay healthy and fit, and we encounter unhealthy food choices such as sugary, unhealthy snacks, we can pause and ask whether saying yes to eating it or not would help us in that goal. Indeed, we would be able to choose the better course of action if we were mindful of the consequences.

5. Examine Failures and Learn to Avoid Them

Charlie Munger has learned to identify risks by examining failure scenarios. Therefore, we can do the same, consider the opposite of what we want to happen and identify the potential risks to our plan.

When we learn from our failures and those of others before us, we can learn to avoid them. Therefore, this lesson is invaluable since the true power of inversion as a mental model is to use it for decision-making and problem-solving.

When we consider the opposite of what we want to happen, we can help identify the risks to our success and plan accordingly to avoid them. Learning from failures and avoiding them can be applied to business, investing, personal relationships, and even our day-to-day decisions.

Charlie Munger’s use of inversion as an investor can help serve as a powerful example of how we can use this mental model to become the best thinkers and decision-makers.

6. Identify Key Factors, Then Invert

One key factor I learned in the inversion mental model way of thinking is that the first step is identifying the key critical factors to achieving my desired result. Firstly, I list all the crucial factors that could help my planning, actions, future decisions, and other circumstances vital to achieving my goal. Therefore, the first step is thinking about and brainstorming these key factors.

I learned that when I have identified these key factors, I need to invert them—figure out the opposite of them to see what I get. For example, if I found myself asking, “What should I do to attract this particular person or thing to me?” Moreover, I asked the opposite question: “What should I NOT do to repel this person or thing from coming my way?”

When we invert the key factors, identifying the roadblocks and obstacles becomes more straightforward. Once we have identified them, we can avoid them! In addition, this method helps us think about our goals in a well-rounded way. We can consider factors that we haven’t considered, and therefore, we are well-prepared.

7. Find the Worst-Case Scenarios

Lastly, the other method of inversion is thinking about the worst-case scenario. Imagine the worst outcome in your situation that would fail in your goal.

Moreover, this method of thinking about the worst-case scenario is helpful in preparing for potential risks and challenges that may arise on our way to our goals. Therefore, this way of thinking can help us manage the risks of these failures. We can identify the obstacles and roadblocks and find ways to mitigate them. We can also mentally prepare ourselves for failure to remain calm and focused in these high-pressure situations.

We must balance this approach with our positive outlook to avoid demotivating ourselves. We must also look for opportunities by constantly thinking about having a growth mindset, which I have written about in this blog.

8. Recommendation for Further Learning

Overall, I have learned that the key to the Inversion Mental Model is widening our thinking and approaching our goals using various perspectives, challenging our assumptions, considering the opposites, and learning from failures. When we do the inversion mental model methods, we can uncover many insights and opportunities that we may have never considered.

I have looked at various books that could help me learn more about mental models and the inversion mental model. Here are my recommendations:

- “The Great Mental Models” by Shane Parrish – This book collects all the mental models into one volume. Learn more about mental models and how they can enrich our thinking.

- “Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger” by Peter D. Kaufman – This book is a compilation of Munger’s speeches, interviews, and other writings. It provides insights into Munger’s approach to investing, business, and life, including using the Inversion Mental Model.

- “The Most Important Thing: Uncommon Sense for the Thoughtful Investor” by Howard Marks – While not specifically about Charlie Munger, this book covers many of the same principles and mental models that Munger espouses, including the Inversion Mental Model.

- “Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts” by Annie Duke – This book explores the idea of thinking in terms of probabilities and potential outcomes, which is a key aspect of the Inversion Mental Model.

- “Seeking Wisdom: From Darwin to Munger” by Peter Bevelin – This book draws on the wisdom of great thinkers, including Charlie Munger, to explore the principles of rational thinking and decision-making.

- “Charlie Munger: The Complete Investor” by Tren Griffin – This book provides a comprehensive overview of Charlie Munger’s life, philosophy, and approach to investing, including his use of the Inversion Mental Model.

These books offer valuable insights into the Inversion Mental Model and Charlie Munger’s approach to thinking and decision-making, and I hope you find them helpful!